My “Real or Fake” series on vintage furniture is, by far, the most popular draw to the JetSetRnv8r site. I’ve received lots of emails asking about other pieces, but none more than Ludwig Mies van der Rohe’s iconic Barcelona Chair, also known as the MR90 so here it is.

Like the other pieces in my series so far, Corbusier’s LC chair, Eames’ Lounge 670 and Ottoman 671 and Noguchi’s coffee table, the Barcelona Chair is one of the most popularly knocked-off pieces of mid-century modern furniture. It’s familiar to everyone because there’s a version of it in nearly every furniture store in the world.

As with many modernist pieces, its simplicity makes it easy to duplicate. Many copies are of exceptionally high quality – some would argue even better than the real thing. This is a case where you can get a good quality knock-off at substantial savings, but, as always, if you’re buying for investment value, only the real thing will do.

The Barcelona chair was designed in collaboration between Ludwig Mies van der Rohe and his partner and companion Lilly Reich in 1929 for the German Pavilion at the Barcelona International Exhibition. Two of these chairs and two matching ottomans were the only pieces of furniture in the pavilion. The chairs were created as thrones for the visiting King and Queen of Spain, and the ottomans were for their attendants.

The originals in the Barcelona Pavilion

King Tut's folding throne

Egyptian folding stool

The design was influenced by ancient designs for folding campaign chairs used by early Egyptians, Greeks and Romans – the similarity is apparent in museum pieces. But its simplicity and grace, the “serenity of line” (as the MoMA website so eloquently describes it) made it an instant symbol of the fledgling modernist movement and it became an immediate sensation. A swooping steel frame with two leather cushions suspended by leather straps – it sounds so simple, but as Mies was famous for saying for saying, “the Devil is in the details”. (He also coined the phrase “less is more”.)

Soon after the closing of the pavilion, the chair went into production at the Bamberg Metal workshop in Berlin. Although the modernist ethos was to build furniture cheaply for the masses, the Barcelona chair was extremely difficult to manufacture and was fabulously expensive from the start.  The earliest versions were made from welding low-grade steel plates in a flat finish – not chromed as they are today – upholstered in white kid leather. Thonet took over production in 1932 until 1948 when Hans Knoll’s wife, designer Florence Knoll, purchased the licensing rights to most of Mies’ furniture and Knoll began manufacturing the chair, which they still do to this day. The chair was such a big seller that Knoll created a whole line of Barcelona furniture inspired by the chairs including Barcelona stools, the Barcelona Daybed, Barcelona Benches, Barcelona sofas, Barcelona coffee table and the Barcelona side table. Many of these pieces are mistakenly attributed to Mies by people who should know better (hear that, DWR catalogue?) but he did not design them.

The earliest versions were made from welding low-grade steel plates in a flat finish – not chromed as they are today – upholstered in white kid leather. Thonet took over production in 1932 until 1948 when Hans Knoll’s wife, designer Florence Knoll, purchased the licensing rights to most of Mies’ furniture and Knoll began manufacturing the chair, which they still do to this day. The chair was such a big seller that Knoll created a whole line of Barcelona furniture inspired by the chairs including Barcelona stools, the Barcelona Daybed, Barcelona Benches, Barcelona sofas, Barcelona coffee table and the Barcelona side table. Many of these pieces are mistakenly attributed to Mies by people who should know better (hear that, DWR catalogue?) but he did not design them.

Barcelona Daybed by Knoll, not Mies

The sofa's not even by Knoll

Although stainless steel had been around since the turn of the century, it did not come into popular use until the 1950s when Mies redesigned the chair to be made from this superior material. Today, the chair is available in a choice of two finishes – chrome plated and polished stainless steel. The two are nearly undistinguishable to the untrained eye, but if you saw them side-by-side, the polished version has a more “liquid” finish. And there is a significant difference in cost – Knoll charges $4,083 for the chrome plated model and a staggering $6,235 for the polished stainless. The matching ottomans are an additional $1,930 and $3,608, respectively.

So the next time you see a stately pair of Barcelona chairs and ottomans in a sleek modernist home, you can appreciate the fact you’re looking at nearly $20,000.

Unless, that is, you’re being deceived by clever fakes. The chair is easy to copy and passable versions are available for as little as $329 online, or $635 including an ottoman. Good quality reproductions can be had for $800 and up. The real deal is made in the U.S.A. but fakes come from Italy, Brazil, China, India, Korea, Vietnam, Russia and Romania. You’ll often see them called “Pavilion Chairs” to avoid trademark infringement.

Knoll modified Mies’ design fairly significantly making today’s chairs very different from the original thrones. Since Knoll took over production, they are generously proportioned and nearly square at 30” high x 30” deep x 29.5” wide with a seat height of 17”. They feature supple leather cushions that subtly follow the curves of the frame and are held in place underneath by matching leather straps. There are no visible welds or seams and the finish is flawless. Once you’ve studied one, the fakes will be easier to spot.

A cheap fake

The first give-away is the proportions. Many cheaper fakes are visibly smaller or appear to stand taller than they are wide – Knoll’s version appears wider than tall. The cushions are often straight and stiff. The leather cheap and shiny. Whereas the Knoll version is upholstered with twenty individual panels, cut and hand-welted and tufted with matching buttons, cheaper copies are simply one piece and pleated. Knoll ottomans stand slightly taller than the edge of the chair seat – many copies have a lower (and more comfortable) ottoman.

Knoll logo in the leg

So if you’re buying vintage, how do you know if you’re getting the real thing? First look for the Knoll Studio logo and Mies’ signature stamped onto the frame. Without that, it’s a fake. If it has the stamp but you think it may be counterfeit, double-check the dimensions of the chair. Then look at the quality of the leather and make sure it’s not a single pleated piece. Check the quality of the leather straps – if they’re vinyl or nylon, walk away.

Welting detail

Matching leather straps

As for prices, this is a case where you can save significantly right now by buying vintage over new. Due to the downturn in the economy, recent auction results have been dire for sellers – you can pick up a pair of excellent vintage chairs in polished stainless steel – some even with the distinguished provenance of being from the Seagram’s Building in New York – for less than $5,000 per pair – with ottomans! Two pairs offered at the October 7, 2008 Wright auction in Chicago estimated at $5-7,000 per pair went unsold. Two pairs at the October 25-26 Rago Arts auction are estimated at $3-5,000 per pair. (UPDATE: The Rago auction sold two chairs in polished steel and black leather for $3,250 for the pair – essentially a third of the price of new. And two chairs with one ottoman in white leather and polished steel got $6,000 for the entire set. A nice discount off the $16,078 list price from Knoll.)

Lot 167 from the 10/25/08 Sollo Rago modern auction. Estimated at $3-5,000. Sold for $6,000.

But if you insist on buying new, buy from an authorized Knoll dealer or reseller like Design Within Reach. If it hurts to write that check, you can comfort yourself with the knowledge that Knoll pays a royalty on each chair to the Museum of Modern Art who now owns the design rights. They should throw in a free museum membership for life with each chair.

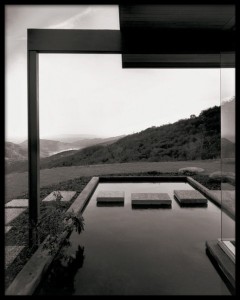

No house has energized this debate more then Neutra’s magnificent Singleton House in the Bel Air neighborhood of Los Angeles. Built in 1959 for the wealthy industrialist Henry Singleton (Teledyne Corp.), and purchased in 2004 by the hair-care tycoon Vidal Sassoon for a reported $6 million, the house was extensively renovated and reconfigured by his wife Ronnie for an attempted “flip” project during the height of the real estate boom. The results, unveiled when the house hit the market in 2008 for an eye-popping $24.5 million, were nothing less than controversial. The milder reviews called the renovation “an act of architectural vandalism” and “hostile to Neutra’s entire vision”.

No house has energized this debate more then Neutra’s magnificent Singleton House in the Bel Air neighborhood of Los Angeles. Built in 1959 for the wealthy industrialist Henry Singleton (Teledyne Corp.), and purchased in 2004 by the hair-care tycoon Vidal Sassoon for a reported $6 million, the house was extensively renovated and reconfigured by his wife Ronnie for an attempted “flip” project during the height of the real estate boom. The results, unveiled when the house hit the market in 2008 for an eye-popping $24.5 million, were nothing less than controversial. The milder reviews called the renovation “an act of architectural vandalism” and “hostile to Neutra’s entire vision”.